Pre tax contribution calculator

Roth 401 k contributions allow you to contribute to your 401 k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn. The annual maximum for 2022 is 20500.

Roth Ira Calculator Roth Ira Contribution

Divide Saras annual salary by the number of times shes paid during the year.

. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. Division 293 tax is an additional tax on super contributions if your combined income and super contributions are more than the threshold. Our Salary sacrifice calculator helps you to compare the effect on take home pay and super contributions by making additional super contributions using two different methods ie as a.

Visit the Social Security please visit the Social Security Calculator smaller taxable income by the Internal Service. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis and pay no taxes on qualifying. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

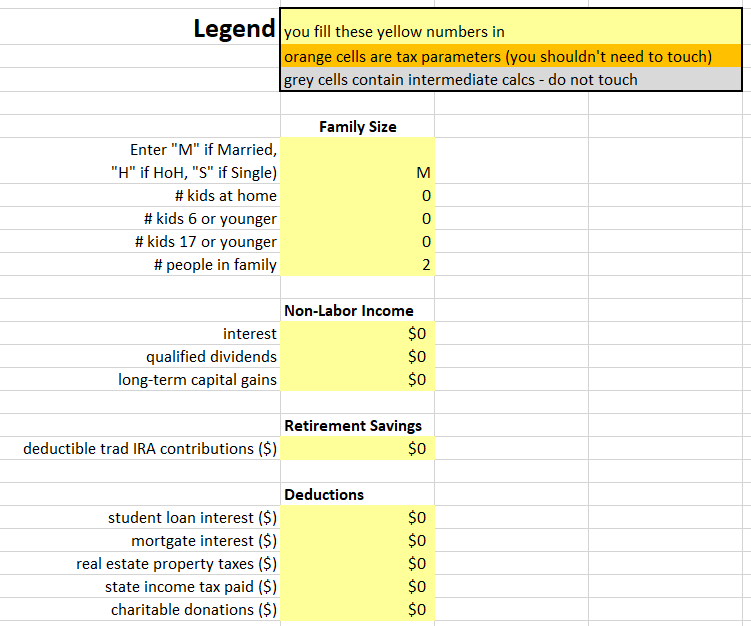

The amount you will contribute to a 457 each year. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. Make post-tax contributions to your super via cheque complete a Member and Spouse Contribution form.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. S are two of the most popular tax. A 457 plan contribution can be an effective retirement tool.

Get your BPAY number. Contribution Calculator for 401k A 401 k Contribution calculator will help one to calculate the contribution that will be made by the individual and the employer contribution as well. Her gross pay for the period is 2000 48000 annual.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. What this means is that taxes are paid upfront and during retirement. Limit helps reduce your tax liability are.

For some investors this could prove. Ad Our Resources Can Help You Decide Between Taxable Vs. Pre-tax contribution is the amount of deductions you make from your monthly gross wage into your 401k retirement savings account BEFORE taxes have been deductedBy making pre-tax.

In general contributions to retirement accounts can be made pre-tax as in a 401k or a traditional IRA. If you are age 50 or over. Calculate the employees gross wages.

Thats where our paycheck calculator comes in. Make post-tax contributions via BPAY. Contributions to a traditional IRA qualify for a tax deduction for the year the.

Division 293 tax for high-income earners. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month. When you make a pre-tax contribution to your.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. However if that employee contributes 15000 towards their 401 k plan their taxable income will be reduced to 75000 - 15000 60000 and their tax liability will be. Similar to Roth IRAs Roth 401ks are retirement plans that utilize after-tax contributions instead of pre-tax income.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pre Tax Income Ebt Formula And Calculator Excel Template

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Traditional Vs Roth Ira Calculator

2021 Tax Calculator Frugal Professor

Pre Tax Income Ebt Formula And Calculator Excel Template

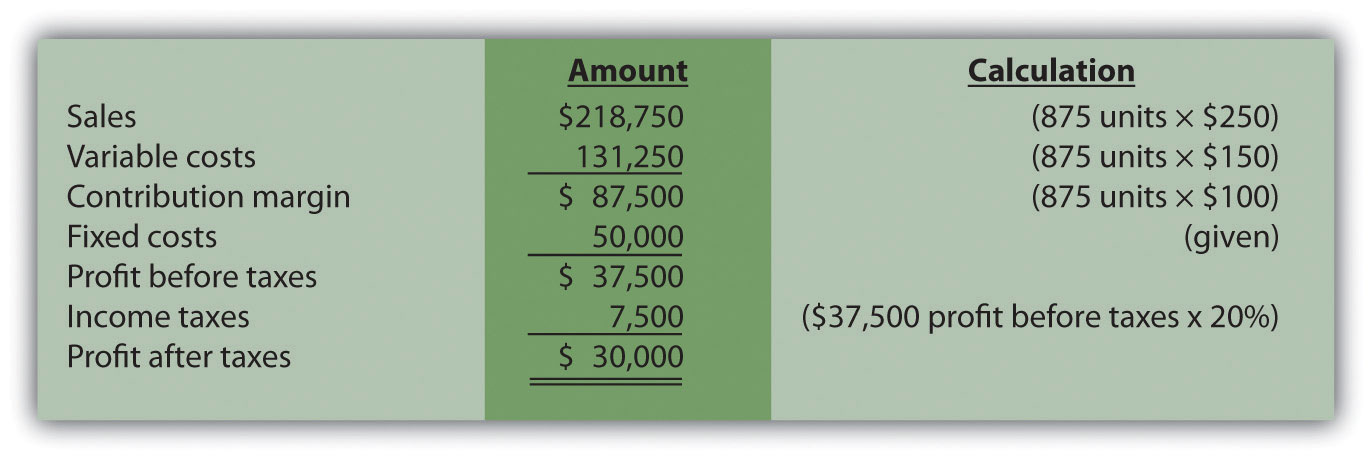

Income Taxes And Cost Volume Profit Analysis

Traditional Vs Roth Ira Calculator

Doing The Math On Your 401 K Match Sep 29 2000

After Tax Contributions 2021 Blakely Walters